Annie Osborne stands in front of the house she has called home for more years than she can remember. Osborne lost her home to tax foreclosure after being unable to pay her taxes for two years. Though Jackson County officially took possession of her home in on April 1, Osborne stayed in the house until late July. She was unclear about whether or not she would be forced to move, regardless of the notices left on her door and the personal visit to her home made by the county treasurer.

Annie Osborne sorts some of her possessions while moving out of the house she lost to tax foreclosure. After living in her home for many years Osborne found packing up to be a daunting challenge. When push came to shove she ended up having to abandon a number of possessions when she left the house.

Annie Osborne speaks with one of her sons before beginning to move out of the house she lost to tax foreclosure. Though Annie was reluctant to tell most people in her family she was losing her home, when it was time to move many of her siblings, grand children and great-grandchildren turned out to help.

"When stuff is steady coming on you, you wonder, 'What is this person going to do?'" Annie Osborne said of her struggle with tax foreclosure. Osborne lost her home to tax foreclosure after being unable to pay her taxes for two years. She was unclear about whether or not she would be forced to move, regardless of the notices left on her door and the personal visit to her home made by the county treasurer.

Annie Osborne sits on her porch contemplating her next move as the clock winds down toward the deadline for her to be out of the property. Osborne had been given an extension on her eviction though the weekend to move out of the home that has been in her family for decades after losing her home to tax foreclosure. Though her family was able to get a number of her possessions out of the house over the weekend, when the deadline passed on Monday morning Annie had not finished moving.

Annie Osborne's great-grandson, Eric, center, checks his arm for scratches after hauling a box out to their U-Haul. Osborne was unable to save her home from tax foreclosure after two years of delinquency. Though the county officially took possession of the property in April, she remained living there until late July. When it became apparent Osborne was not going to be able to stay in her home until the annual auction many members of her family scrambled to help her clear the house.

Annie Osborne, left, sorts through her possessions while her great-grandson, Eric, hauls a box out to their U-Haul. Osborne was unable to save her home from tax foreclosure after two years of delinquency. Though the county officially took possession of the property in April, she remained living there until late July. When it became apparent Osborne was not going to be able to stay in her home until the annual auction, when her son plans to repurchase the house, many members of her family scrambled to help her clear the house.

Because there is no penalty on a credit report for allowing a property to be taxed foreclosed, often someone will purchase a property at auction with the intent of renovating and end up allowing the house to go back to the county. This house, located in Jackson, has been tax foreclosed on at least once before.

Annie Osborne takes a break in between carting boxes out of her former home in Jackson. Tax foreclosure, an increasingly common issue in Jackson County, often claims homes fully owned by their occupants. Though Annie's family had owned her home outright for several years, her inability to pay her taxes ultimately lost the house.

Karen Coffman, Jackson County treasurer, glances around a house filled with the personal effects of the last residents while making the rounds after the yearly tax foreclosure acquisitions by the county. Many people simply leave behind most of the possessions when they lose their homes. Though they aren't under any obligation, Jackson County does clean out the homes and work on their upkeep during the months they're in the county's possession.

Personal belongings litter the floor in a tax foreclosed house in Jackson. Often families will wait until forcibly evicted to leave the house and end up leaving behind much of their property.

Pat Cripes, right, and her daughter, Heidi Fagerholm, check out a basement bathroom in a house the county has taken possession of due to tax foreclosure. The pair assess the houses, looking for potential maintenance issues as well as trying to discern which are more likely to sell in the upcoming annual county auction.

Pat Cripes, right, speaks with a neighbor of one of the tax foreclosed properties she is assessing. Pat and her husband fix up tax foreclosed properties after the county has taken possession in preparation for their auction. The neighbor expressed interest in buying the house next door.

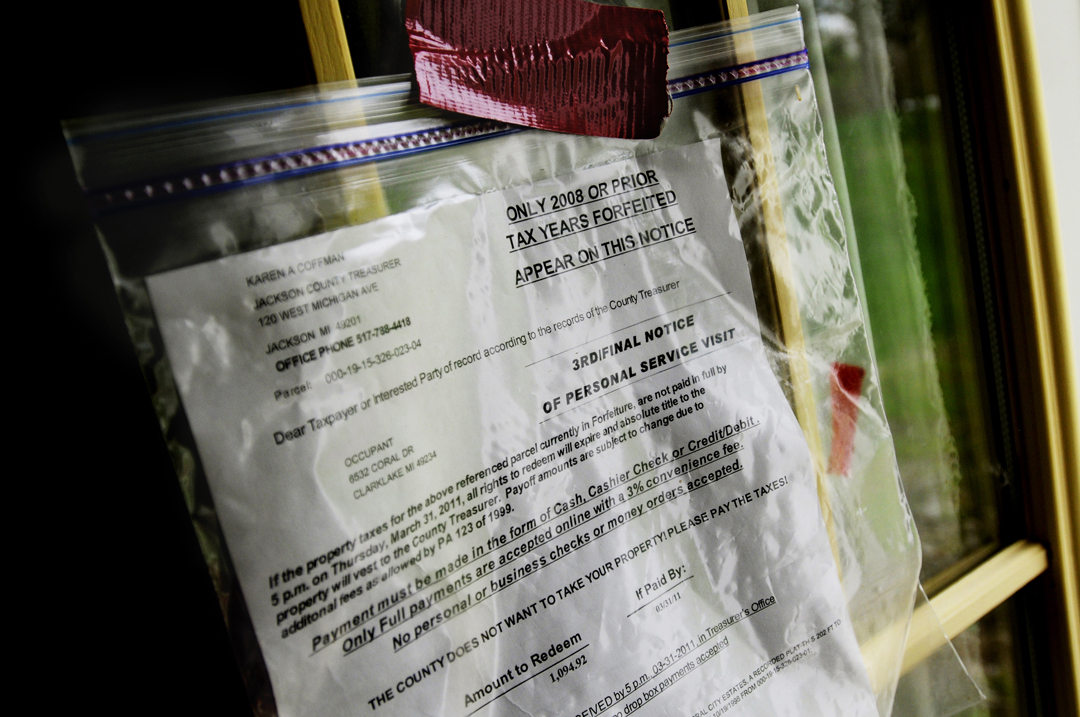

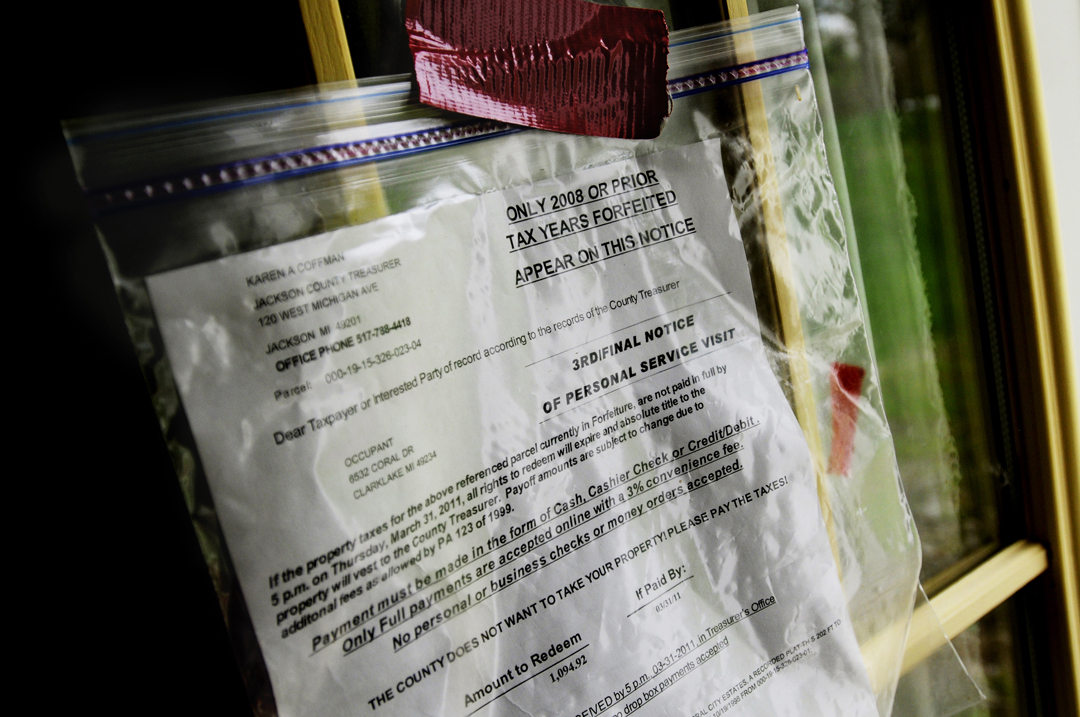

The red tape that usually accompanies tax foreclosure notices is present on one property with lake access that is delinquent for $1,094.92. Many people loose their property to tax foreclosure for no more than a few thousand dollars. Because tax foreclosure numbers are low when compared with mortgage foreclosure rates little local or federal attention has been turned to relief. Often, homeowners have no organizations they can turn to for aid when they run into trouble paying their taxes.

A member of Pat and Reuel Cripes' crew cleans out a kitchen in a property Jackson County had taken possession of due to tax foreclosure. Though not all the homes in the county's possession are cleaned to such an extent, the few that will be shown in open house before the annual auction are throughly scrubbed.

Jordan Cannon, 7, center, hugged her cousin's girlfriend, Misty Johnson, as the two stood on the steps of a home during a tax foreclosure open house in Jackson. Cannon's father, Rev. Gordon Cannon, far left, said he was looking into buying the home for his son, not pictured, after he graduated high school. This two bedroom, one bathroom ranch house was going up to auction with a minimum bidding price of $4,650. Minimum bids begin at the price of back taxes on a property. The low price can allow families to purchase homes who might have bee unable to do so otherwise.

Annie Osborne stands in front of the house she has called home for more years than she can remember. Osborne lost her home to tax foreclosure after being unable to pay her taxes for two years. Though Jackson County officially took possession of her home in on April 1, Osborne stayed in the house until late July. She was unclear about whether or not she would be forced to move, regardless of the notices left on her door and the personal visit to her home made by the county treasurer.

Annie Osborne sorts some of her possessions while moving out of the house she lost to tax foreclosure. After living in her home for many years Osborne found packing up to be a daunting challenge. When push came to shove she ended up having to abandon a number of possessions when she left the house.

Annie Osborne speaks with one of her sons before beginning to move out of the house she lost to tax foreclosure. Though Annie was reluctant to tell most people in her family she was losing her home, when it was time to move many of her siblings, grand children and great-grandchildren turned out to help.

"When stuff is steady coming on you, you wonder, 'What is this person going to do?'" Annie Osborne said of her struggle with tax foreclosure. Osborne lost her home to tax foreclosure after being unable to pay her taxes for two years. She was unclear about whether or not she would be forced to move, regardless of the notices left on her door and the personal visit to her home made by the county treasurer.

Annie Osborne sits on her porch contemplating her next move as the clock winds down toward the deadline for her to be out of the property. Osborne had been given an extension on her eviction though the weekend to move out of the home that has been in her family for decades after losing her home to tax foreclosure. Though her family was able to get a number of her possessions out of the house over the weekend, when the deadline passed on Monday morning Annie had not finished moving.

Annie Osborne's great-grandson, Eric, center, checks his arm for scratches after hauling a box out to their U-Haul. Osborne was unable to save her home from tax foreclosure after two years of delinquency. Though the county officially took possession of the property in April, she remained living there until late July. When it became apparent Osborne was not going to be able to stay in her home until the annual auction many members of her family scrambled to help her clear the house.

Annie Osborne, left, sorts through her possessions while her great-grandson, Eric, hauls a box out to their U-Haul. Osborne was unable to save her home from tax foreclosure after two years of delinquency. Though the county officially took possession of the property in April, she remained living there until late July. When it became apparent Osborne was not going to be able to stay in her home until the annual auction, when her son plans to repurchase the house, many members of her family scrambled to help her clear the house.

Because there is no penalty on a credit report for allowing a property to be taxed foreclosed, often someone will purchase a property at auction with the intent of renovating and end up allowing the house to go back to the county. This house, located in Jackson, has been tax foreclosed on at least once before.

Annie Osborne takes a break in between carting boxes out of her former home in Jackson. Tax foreclosure, an increasingly common issue in Jackson County, often claims homes fully owned by their occupants. Though Annie's family had owned her home outright for several years, her inability to pay her taxes ultimately lost the house.

Karen Coffman, Jackson County treasurer, glances around a house filled with the personal effects of the last residents while making the rounds after the yearly tax foreclosure acquisitions by the county. Many people simply leave behind most of the possessions when they lose their homes. Though they aren't under any obligation, Jackson County does clean out the homes and work on their upkeep during the months they're in the county's possession.

Personal belongings litter the floor in a tax foreclosed house in Jackson. Often families will wait until forcibly evicted to leave the house and end up leaving behind much of their property.

Pat Cripes, right, and her daughter, Heidi Fagerholm, check out a basement bathroom in a house the county has taken possession of due to tax foreclosure. The pair assess the houses, looking for potential maintenance issues as well as trying to discern which are more likely to sell in the upcoming annual county auction.

Pat Cripes, right, speaks with a neighbor of one of the tax foreclosed properties she is assessing. Pat and her husband fix up tax foreclosed properties after the county has taken possession in preparation for their auction. The neighbor expressed interest in buying the house next door.

The red tape that usually accompanies tax foreclosure notices is present on one property with lake access that is delinquent for $1,094.92. Many people loose their property to tax foreclosure for no more than a few thousand dollars. Because tax foreclosure numbers are low when compared with mortgage foreclosure rates little local or federal attention has been turned to relief. Often, homeowners have no organizations they can turn to for aid when they run into trouble paying their taxes.

A member of Pat and Reuel Cripes' crew cleans out a kitchen in a property Jackson County had taken possession of due to tax foreclosure. Though not all the homes in the county's possession are cleaned to such an extent, the few that will be shown in open house before the annual auction are throughly scrubbed.

Jordan Cannon, 7, center, hugged her cousin's girlfriend, Misty Johnson, as the two stood on the steps of a home during a tax foreclosure open house in Jackson. Cannon's father, Rev. Gordon Cannon, far left, said he was looking into buying the home for his son, not pictured, after he graduated high school. This two bedroom, one bathroom ranch house was going up to auction with a minimum bidding price of $4,650. Minimum bids begin at the price of back taxes on a property. The low price can allow families to purchase homes who might have bee unable to do so otherwise.